Okay, folks, buckle up. We're diving headfirst into the swirling vortex of crypto's evolution, and what a ride it's shaping up to be! The "Global Crypto Policy Review & Outlook 2025/26 Report" from TRM Labs just dropped, and let me tell you, it's like peering into a crystal ball – a crystal ball powered by blockchain, naturally. You can read the full Global Crypto Policy Review Outlook 2025/26 Report - TRM Labs here.

What's immediately striking is the sheer pace of change. We’re not talking incremental tweaks here; we’re talking a full-blown metamorphosis. Over 70% of the jurisdictions TRM Labs reviewed are actively shaping stablecoin regulations. Seventy percent! That's not just a trend; that's a tidal wave. And get this – financial institutions in about 80% of those same jurisdictions are launching new digital asset initiatives. I mean, come on! This isn't just about the fringe anymore; this is about the financial establishment waking up and realizing that crypto isn't going away – it's the future, and they want a piece of it.

This isn't just about regulation; it's about legitimation. Think back to the early days of the internet – a Wild West of dial-up modems and Geocities websites. Now, imagine someone telling you back then that one day, the internet would be the backbone of global commerce, powering everything from streaming movies to self-driving cars. You'd probably laugh, right? Well, that's where we are with crypto right now. We're seeing the infrastructure being built, the rules being written, and the foundation being laid for a future where digital assets are as commonplace as email.

The report highlights some fascinating regional nuances. In the US, President Trump's executive order focusing on innovation and rejecting a retail CBDC, coupled with the passage of the GENIUS Act on stablecoins, signals a clear direction: embrace the technology, but do it responsibly. Meanwhile, the EU's MiCA rules are now in full swing, and countries like Germany and France are actively issuing licenses to crypto asset service providers (CASPs). It's like watching different pieces of a puzzle come together, each region contributing its unique perspective and approach.

Of course, it's not all sunshine and rainbows. The report also touches on the darker side of crypto, like North Korea's audacious hack of Bybit, netting over $1.5 billion in Ethereum tokens. And let's not forget Argentina's brief flirtation with the $LIBRA meme coin, which quickly devolved into a judicial investigation. These events serve as stark reminders that with great power comes great responsibility, and that the crypto space is still vulnerable to bad actors and market manipulation. This is where the Beacon Network comes in, a real-time information-sharing platform, is a huge deal. VASPs and law enforcement agencies are using it to share information in real-time.

The fact that VASPs have significantly lower rates of illicit activity than the overall crypto ecosystem is also a huge win. It proves that regulation and compliance can actually make a difference, cleaning up the space and making it safer for everyone. The launch of Beacon Network, a real-time information-sharing platform, has been met with support from VASPs representing over 75% of total crypto volume, as well as more than 60 law enforcement agencies across 15 countries.

But here's the thing that really excites me: the global collaboration. FATF, FSB, IOSCO – these international bodies are all working together to create a cohesive regulatory framework for crypto. It's like the world is finally waking up to the fact that crypto is a global phenomenon, and that it requires a global response. What happens when these standards aren't upheld? The Basel Committee announced plans to review the standards, after the US and UK refused to implement them.

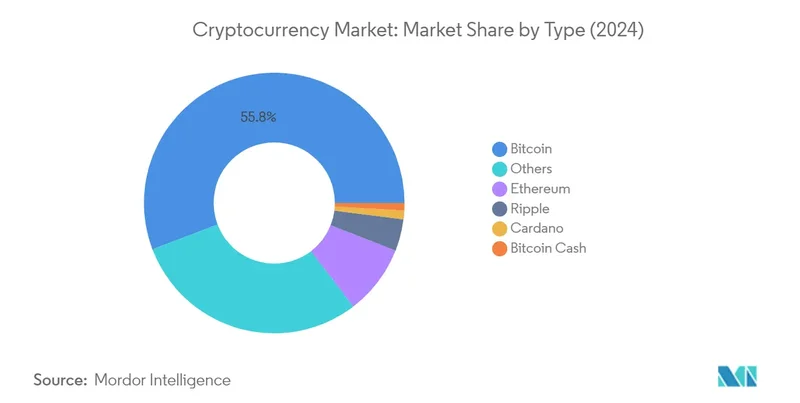

The report also sheds light on the growing institutional adoption of crypto. Financial institutions in about 80% of the reviewed jurisdictions are announcing new digital asset initiatives, which is just staggering. This isn't just about hedge funds and venture capitalists anymore; it's about traditional banks and asset managers getting in on the action. And that, my friends, is a game-changer. Further analysis of cryptocurrency market activity and the role of cloud computing platforms can be found at Analysis Of Cryptocurrency Market Activity And The Role Of Cloud Computing Platforms - Block Telegraph.

What does this mean for the average person? Well, imagine a future where your savings account earns interest in crypto, or where you can easily send money to friends and family overseas without exorbitant fees. Imagine a world where small businesses can access capital more easily through decentralized lending platforms, or where artists and creators can monetize their work directly without relying on intermediaries. That's the promise of crypto, and it's a promise that's starting to become a reality.

Now, of course, there are still plenty of challenges ahead. We need to address concerns about energy consumption, market volatility, and the potential for illicit activity. We need to ensure that crypto is accessible to everyone, regardless of their technical expertise or financial resources. And we need to foster a culture of innovation and experimentation while also protecting consumers and investors. But I'm confident that we can overcome these challenges. The talent, the resources, and the will are all there.

Think about the early days of the automobile. People were scared of these noisy, unreliable machines. They worried about safety, pollutio